Industrials/ Engineering construction/ Partnership Models 0 comments

(P.S: Sorry for any disturbances the advertisements above may have caused you)

Since infrastructure, especially water engineering, is one of the hot sectors on the stock market nowadays, I thought it would be good to start with something on this sector (and me being in the engineering profession, it is also a convenient place to start).

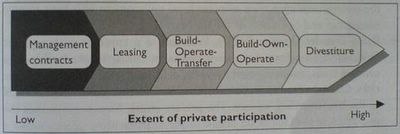

For the water engineering companies, we have seen a variety of engineering partnership agreements with the respective municipal or industrial customers to undertake the projects. Such infrastructure projects are seldom turnkey as the government prefers to outsource the O&M (operations and maintenance)to the same contractor (turnkey, of course, is best from the viewpoint of the investor, because it releases capital once construction is completed..... too bad). For example, Boustead's water engineering subsidiary Salcon entered into a build-operate-transfer (BOT) agreement with Yogyakarta's municipal government in a big 2005 contract, while later in the year they secured another contract to build a water treatment plant in China, this time on a build-own-operate (BOO) basis. It is worth understanding the various types of partnership agreements; this allows a better insight into the risks involved. BOT and BOO are probably the two most common engineering partnership agreements for such capital/infrastructure projects contracted with local governments, particularly in emerging market countries (such as Indonesia and China); but there are other types.

BOT involves the private sector (the construction company) building the facility, operating it on a government concession for a number of years (usually 30 or more), and then transferring the asset to the government. The local government, typically, is not prepared to withdraw completely from the provision of such an infrastructure service, hence the limited operating period. Of course, the private company recoups its construction costs through cash inflows over the operating period.

Compared to BOT, BOO appears to be more risky to the private builder/operator. It involves complete ownership and operation of the asset after construction completion, without the final ownership transfer. Obviously, there is higher ownership risk to the private operator, since the government does not have an inherent share in the asset like in the BOT agreement. This has to be made up by higher tariffs and profit margins. In fact, an analogy could be made by comparing BOT to bonds, and BOO to stocks. For both, there are recurring payments through coupon yield (bonds) or dividends (stocks) but for the former the principal sum accrues to the holder at the end, while for the latter there is none; the compensation of course is through higher expected return for stocks/BOO.

As mentioned, there are other less common partnership agreements:

- Supply-operate-transfer: Same as BOT, except that the private company involved is the manufacturer of equipment for the infrastructure facility.

- Build-transfer: Asset transfer to the government directly after construction completion -- usually for sensitive/critical facilities considered strategic by the government

- Build-develop-operate-transfer: Similar to BOT but additional rights are given to the contractor to develop the surrounding area and enjoy additional income eg. the contractor builds the road and is granted the additional right to build and operate restaurants off the roadside).

- Refurbish-operate-transfer & Refurbish-own-operate: The refurbishing equivalent of BOT and BOO --- the contractor rehabilitates an existing facility, instead of building a greenfield development from scratch.

References:

(1) Financing Large Projects (Kabir Khan, Robert Parra

0 Comments:

Post a Comment

<< Home