Property / Developer / Singapore district categories 3 comments

(P.S: Sorry for any disturbances the advertisements above may have caused you)

Some of this may be pretty basic to veteran property investors and yet it might be useful reference for some. As they say, in property, it's about location, location, location.

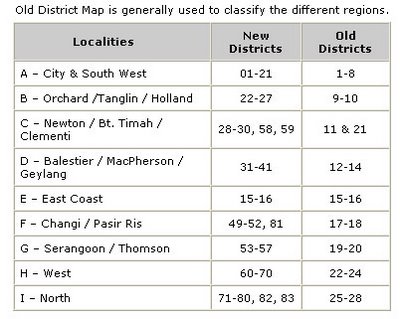

The district classification of Singapore property

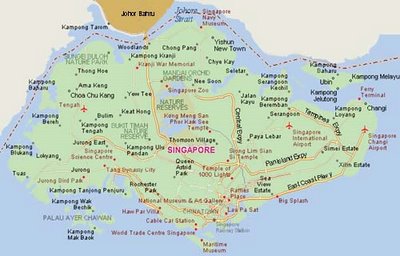

For reference, the various areas by their normal names:

To add some value to the article from the point of residential property:

Properties in the prime districts of 9, 10 and 11 are still the most sought after. Prime developments such as Regency Park, Four Seasons Park and Nassim Jade, alltime favorites for expatriates, are located here.

Properties in districts 15 and 16 (East Coast), and 5 (Clementi and Pasir Panjang) are also popular. These locations are desirable due to their central location and proximity to shopping, recreation amenities and international schools.

For investments (rental), these are typically areas to go for, because they are popular with foreigners (who would typically be the ones renting).

References:

(1) Singaporeproperty.com

(2) Colliers April 2005 Research Paper: Singapore Residential Property Market: Investing in Residential Properties

3 Comments:

How do you know when is a good time to buy stock?

1) Base on Business cycle on each sector?

2) or base on the whole economic business cycle?

3) or the stock chart simply show that is bottom?

What are the key indicator that you are watching?

Please clearly state the procedure on how you done your research?

Sorry for asking non-relevant question to your article posting.

Hi chua,

You can read my views in the Buying/Selling/Holding section as well as the Investing Philosophy section in my MyStockThoughts blog; the link is www.mystockthoughts.blogspot.com

A distillation of the views is that:

- practise market timing in a limited manner because you will have psychological problems reversing when you get it wrong, and hence suffer opportunity costs

- price movements are usually driven by the market, sector and individual company in about 40:30:30 manner (qualitatively speaking)

- it is better to concentrate your efforts on the last 60% ie. sector and company.

- buying is not so important (although obviously you must pick the right stocks); it is management of risk (how you deal with under-performing stocks) and having the correct selling mentality, that allows you to make good profits.

- understand who you're buying from, and why they're selling to you.

Cheers,

DanielXX

I think its now time to stay clear of most developing stock markets and take a look at some of the cheap stocks in the euro zone and the united states.

Post a Comment

<< Home